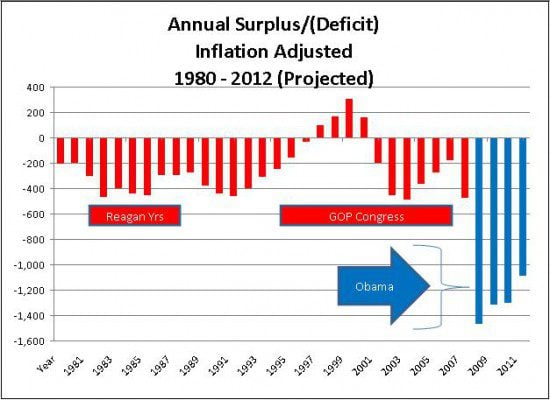

The Obama-Pelosi Democrats tripled the deficit and increased the national debt by over $5 trillion – now they want you to pay up.

Four straight years with a trillion dollar deficit–

(J. Hoft Chart)

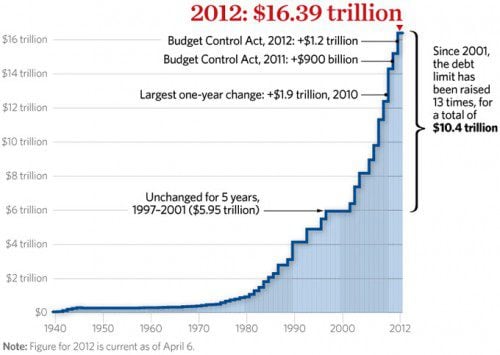

Barack Obama added $5 trillion to national debt in a little over 3 years.

Another record.

(Heritage)

Soon to be $6 trillion.

Barack Obama and Democrats added over one trillion dollars to the annual Federal Budget in the last 4 years.

That’s at least a 30% increase in federal spending in just 3 years.

Today Democrats will threaten in a speech to take the country over a “fiscal cliff” if they can’t raise taxes.

The Washington Post reported, via Free Republic:

Democrats are making increasingly explicit threats about their willingness to let nearly $600 billion worth of tax hikes and spending cuts take effect in January unless Republicans drop their opposition to higher taxes for the nation’s wealthiest households.

Emboldened by signs that GOP resistance to new taxes may be weakening, senior Democrats say they are prepared to weather a fiscal event that could plunge the nation back into recession if the new year arrives without an acceptable compromise.

In a speech Monday, Sen. Patty Murray (Wash.), the Senate’s No. 4 Democrat and the leader of the caucus’s campaign arm, plans to make the clearest case yet for going over what some have called the “fiscal cliff.”

“If we can’t get a good deal, a balanced deal that calls on the wealthy to pay their fair share, then I will absolutely continue this debate into 2013,” Murray plans to say, according to excerpts of the speech provided to The Washington Post.

If the tax cuts from the George W. Bush era expire and taxes go up for everyone, the debate will be reset, Murray is expected to say. “Every proposal will be a tax-cut proposal,” according to the excerpts, and Republicans would no longer be “boxed in” by their pledge not to raise taxes.

“If middle-class families start seeing more money coming out of their paychecks next year, are Republicans really going to stand up and fight for new tax cuts for the rich? Are they going to continue opposing the Democrats’ middle-class tax cut once the slate has been wiped clean? I think they know this would be an untenable political position.”

Murray’s address, set to be delivered at the Brookings Institution, is meant to influence both the Nov. 6 election and the lame-duck legislative session in November and December, when the fiscal cliff will be at hand and the fight over taxes will be in full throttle. Regardless of the election’s outcome, President Obama and the current Congress will be in office for the session.

The speech comes less than a week after Obama assured Hill Democrats during a White House meeting that he would veto any attempt to maintain the Bush tax cuts on income over $250,000 a year, according to several people present. It also echoes the dismissive response by Senate Majority Leader Harry M. Reid (D-Nev.) to Republicans seeking to undo scheduled reductions in Pentagon spending that even Defense Secretary Leon E. Panetta has said would be “devastating” to national security.